Retirement Age Singapore Cpf

You will join CPF LIFE if you are a Singapore Citizen or Permanent. There are of course certain conditions to be met.

Cpf Contributions In Singapore India Dictionary

Retirement Solutions Changes to Singapores retirement age and CPF contributions rates March 2021 2 As a major employer the public sector has committed to increase the retirement and re-employment ages one year ahead of the nation-wide implementation of the first step increase.

Retirement age singapore cpf. The official retirement age in Singapore is 62 and the re-employment age at 67. Withdrawals of CPF savings from 55. SINGAPORE The retirement and re-employment ages for Singapore workers will be progressively raised to 65 and 70 years old respectively under the law to support older Singaporeans who wish to continue working to do so.

Back in 2019 the Tripartite Workgroup on Older Workers recommended that Singapores retirement and re-employment age be changed in a step-by-step process. So while the notion of pushing the retirement age upward as the society is getting older is of course logical and not at all novel Singapore not only is already doing that but it is also offering a range of incentives and protections to encourage work for longer than any other country does while leaving the final decision on the exact time of their retirement to people themselves. SINGAPORE Two Bills on raising the retirement and re-employment age and on Central Provident Fund CPF rules were debated in Parliament on Monday Nov 1.

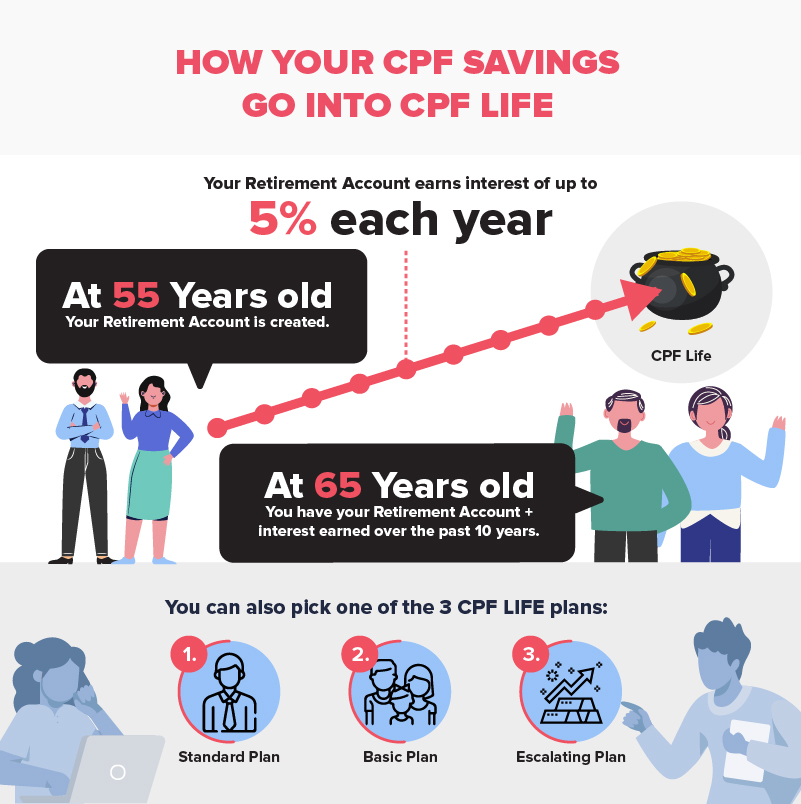

From the age of 55 onwards CPF members have an additional Retirement Account which is used to set aside a statutory Minimum Sum which must be held for the exclusive purpose of retirement. Singapores normal retirement age will increase to 65 years and the re-employment age to 70 by 2030 the prime minister confirmed in a speech at Singapores National Day Rally. From age 55 to the time you join CPF LIFE this retirement sum will continue to grow with interest.

Starting from 1 Jul 2022 the retirement age will be raised to 63 and the re-employment age raised to 68. Manpower Minister Tan See. You decide when you start your payouts.

Do note that re-employment is subjected to eligibility. Raising Singaporean Retirement Age CPF Contribution 2022. SINGAPORE - Two Bills on raising the retirement and re-employment age and on Central Provident Fund CPF rules were debated in Parliament on.

More than 20 MPs spoke on various topics concerning mature workers such as ageism in the workplace and whether a retirement age is still needed. The more you set aside the higher your monthly payouts. The Payout Eligibility Age which is 65 years old is the age that you can start receiving your retirement payouts.

When you reach 55 years old there will be a Retirement Account created for you. Joined your employer before you turned 55. SINGAPORE The payout rules for the Retirement Sum Scheme under the Central Provident Fund CPF will change in 2020 with payouts lasting up to age 90 at most instead of up to age.

Read here to find out the retirement sums. You have this protection if you. The increase of Central Provident Fund CPF contribution rates in Singapore for older Singapore workers will also.

Singapore will raise the retirement age and re-employment age to 65 and 70 respectively by 2030 alongside increases in the Central Provident Fund CPF contribution rates for. Withdrawal at 55 and Payouts at Retirement. Your company cannot ask you to retire before that age.

Increase in Retirement Age Announced. So what is the retirement age in Singapore. According to the Ministry of Manpower MOM the official statutory retirement age in Singapore is currently at 62 years old.

Having more than the Full Retirement Sum enables us to withdraw anything above it while the rest of it flows into our Retirement Account. There are no changes to CPF withdrawal ages. Each CPF member not the CPF Board decides when to start hisher own retirement payouts.

SINGAPORE Twenty years after the retirement age was last raised to 62 the Government will increase it to 65 by about 2030 while the re-employment age will go up from the current age. Are a Singapore citizen or Singapore permanent resident. Beginners Guide Understanding CPF LIFE And Your Monthly Payouts When You Retire In Singapore.

This means that your employers cannot ask you to retire before that 62 and re-employment must be offered should you wish to continue working up to the age of 67 within the company. However on August 18 the Prime Minister of Singapore announced that the retirement and re-employment age will be increased to 65 and 70 respectively by 2030 alongside increases in the Central Provident Fund CPF contribution rates for. There is no change to the Payout Eligibility Age it is 65.

This amount will then be used to join CPF LIFE when you are ready to start your monthly payouts. Older employees contribution rate to the Central Provident Fund CPF also will increase but the CPFs withdrawal age will remain the same. Currently the Minimum Sum amounts to EUR 49232 SGD 99600 and will be increased continuously to EUR 59316 SGD 120000 by 2013.

This has always been the case. Withdrawals of CPF savings from 55. So while the notion of raising the retirement age as society ages is of course logical and nothing new Singapore is not only already doing it but also offering a variety of incentives and protections to encourage working during longer than any other country leaving the final decision on the exact timing of your retirement to the people themselves.

That means that your company cannot ask you to leave before that age for age-related reasons. Retirement and re-employment ages raised to 63 and 68. Which is currently at age 65.

In accordance with the Retirement and Re-employment Act RRA the minimum retirement age is 62 years. In 2022 the retirement age in Singapore will be increased to 63 for females and 68 for males. You can start to withdraw money from CPF when you are 55 years old and you can receive CPF payouts when you are 65 years old.

This will be locked away to enter the CPF LIFE scheme from age 65. Information on Retirement Sum Scheme that provides CPF members a monthly income to support a basic. Manpower Minister Josephine Teo has confirmed that raising the Singaporean retirement age to 63 and the re-employment age to 68 will proceed as planned on July 1 2022.

Ndr2019 Retirement Age And Cpf Infographic The Policypal Blog

The Case For Restoring Cpf Contribution Rates Of Older Workers Today

Gov Sg Can I Make Lump Sum Cpf Withdrawals

Gov Sg 5 Benefits Our Cpf System Has Over Other Pension Systems

Preparing For Retirement Tips To Get Yourself Ready Dbs Singapore

Cpf Contribution Rates Download Table

Retirement Planning In Singapore A Starter Guide For Confused Millennials Money News Asiaone

National Day Rally 2019 Higher Cpf Contribution Rates For Older Workers

Gov Sg 5 Benefits Our Cpf System Has Over Other Pension Systems

Global Pension Index Urges S Pore To Raise Cpf Withdrawal Retirement Age

Cpf Board Turning 55 This Year Find Out How Much You Could Receive Each Month From Cpf Life Based On The Retirement Sum That You Ve Set Aside In Your Retirement Account

Retirement And Re Employment Ages To Be Raised By 3 Years Cpf Contribution Rates For Older Workers To Go Up Today

Cpf Board Clarifies Online Message Suggesting Retirement Payout Age Was Shifted From 65 To 70 Is Wrong Singapore News Top Stories The Straits Times

Full Restoration Of Cpf Contributions For Those Aged 55 To 60 Higher Rates For Workers Above 60 Hr Guru Singapore

If Only Singaporeans Stopped To Think Cpf Life Payouts Minimum Age For Withdrawal Stays At 65

Cpf Board Turning 55 Soon Here S A Quick Overview Of Facebook

What Is The Correct Age To Retire In Singapore Singsaver

Should I Top Up My Cpf Ra To Ers I Have Enough Oa Balance To Cover It Assuming I Do A Oa To Ra Transfer I Understand That The Transfer Is Irreversible